A Tenant’s Guide To Bond Deductions For Cleaning In Victoria

Nothing is more disheartening than losing your significant part of bond at the end of your tenancy. Tenants in Victoria often fail the final rental inspection due to cleaning issues. If the exit condition report flags property maintenance and cleanliness issues, it can lead to unnecessary stress. However, it is crucial to understand the key reasons for deductions and the strategies to handle them to claim your bond back.

It is imperative for tenants/renters to know their rights and responsibilities to prevent unfair deductions, penalties and awful disputes. You should know what landlords can and can't deduct so you can handle the process with confidence. Fret not! Here is a comprehensive guide to help tenants approach the bond deduction for the cleaning scenario the right way. Know what evidence matters, and how to maximise your chance of getting your full bond back.

Make sure you follow these tips carefully, know your rights as a tenant and keep optimistic, especially if you have hired professionals for a top quality end of lease cleaning Melbourne. You don’t need to take stress because the RTBA carefully review inspection reports before any bond claims are approved.

Let’s Get Started!

Hide

Show

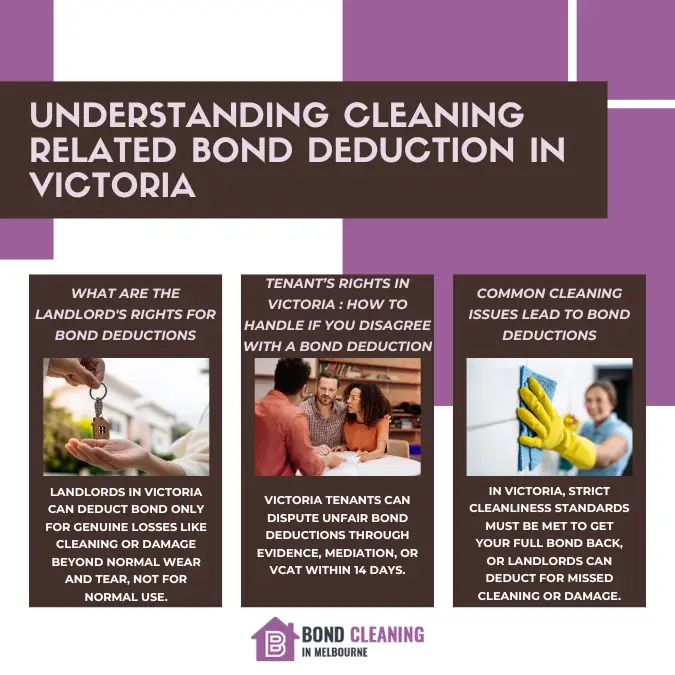

- What Are the Landlord's Rights for Bond Deductions

- Common Cleaning Issues Lead to Bond Deductions

- Tenant’s Guide: What Laws Say About Cleaning Obligations

- How Much Money Can Be Deducted from the Bond for Cleaning?

- Why Evidence Matters In the Case of Bond Deductions?

- Tenant’s Rights in Victoria : How to Handle if You Disagree with a Bond Deduction

- How End of Lease Cleaners Reduce the Chance of Bond Deduction

- Infographic: Understanding Cleaning Related Bond Deduction In Victoria

- Wrapping Up

1. What Are the Landlord's Rights for Bond Deductions

Landlords or rental providers in Victoria are legally allowed to hold back your bond only when they can proof a genuine loss to the property. If the property is not restored to a reasonably clean condition, minus normal wear and tear, the landlord has the right to deduct full or partial bond money to cover the cleaning cost.

Apart from cleaning, they can also make deductions if the property is damaged beyond normal wear and tear, such as holes in walls, broken window frames, glass doors, or leaky taps caused by negligence. Other reasons include outstanding rent and bills, missing property items, renovations without permission, etc. Under these circumstances, landlords can withhold your hard earned money to bring the property back to its actual condition according to the lease agreement.

Note: They can't unfairly deduct for normal wear and tear, such as faded paint, minor scuff marks, or damage from daily use.

2. Common Cleaning Issues Lead to Bond Deductions

Cleaning a rental property in Victoria is not enough to secure the full bond, which is equivalent to four weeks' rent. The property must meet the strict cleanliness standards set by landlords or property managers. They will conduct a final inspection and compare the entry condition report with the current condition to check for dirt, grime, grease, pest and damage. They can reject the bond refund or deduct money due to the following cleaning reasons:

- Dust laden ceiling fans, light fixtures, fittings and blinds

- Grease inside the kitchen appliances like an oven, microwave and refrigerator

- Unclean rangehood and filters

- Sticky cabinets and handles

- Dirty window sills and frames

- Soap scum on showerheads and bathtubs

- Not cleaning inside a toilet seat

- Dingy and discoloured grout lines

- Scuff marks on walls

- Dust embedded carpets or stubborn stains

- Damaged walls

- Overlooked outdoor areas

- Missed hard to reach areas, such as door tracks, skirting boards, patio floors, etc

- Stained flooring

That’s one of the reasons why tenants outsource end of lease cleaning Melbourne professionals. They follow a pre-approved cleaning checklist to meet landlord’s strict standards and specific cleaning clauses for a hassle free experience.

3. Tenant’s Guide: What Laws Say About Cleaning Obligations

Under Victoria's residential rental laws, tenants must leave the property in 'reasonably clean' condition, i.e the same as at the start of the lease, except for normal wear and tear. It is important to maintain a tidy property during the tenancy and hand it over in a habitable condition, leaving no traces of dirt or grime.

The landlord thoroughly inspects the property and may holdback your bond money due to unsatisfactory results. However, they need to justify the claim before making deductions, using evidence such as a copy of the condition report or photos.

As a tenant, you can dispute a deduction because rental laws in Victoria clearly state that the landlord can't make unfair or excessive bond deductions. The Residential Tenancies Bond Authority won't release the money until both parties agree or VCAT makes a legal decision.

4. How Much Money Can Be Deducted from the Bond for Cleaning?

There is no fixed cleaning fee set by the Rental laws in Victoria. However, landlords may withhold a full or partial bond depending on the property’s condition. However, it must be reasonable and proportionate to the cleaning requirement. VCAT usually considers the condition report at the start and end of the lease for clear comparison. They also consider the reasonable cost of remedial cleaning needed to restore the property to its actual condition. As a tenant, you can easily dispute any extra charges via the RTBA.

5. Why Evidence Matters In the Case of Bond Deductions?

If you've thoroughly cleaned your property according to the pre approved cleaning checklist, you can discuss the bond deduction. Since the rental provider or landlord claims amount from the bond via the RTBA online system, make you apply to the same authority to get the full bond back. Whether you are doing a DIY bond cleaning or hiring experts, make sure you arrange evidence to prove your claim matters to secure bond.

The RTBA gives written notice to the landlord and they have 14 days to contest the claim and show evidence of a RDRV or VCAT application. Tenants should also gather necessary evidence to support their claim for unfair deductions. This includes:

The copy of the entry condition report, dated photographs of the entire property's condition, condition of exit reports, receipts of professional end of lease cleaning Melbourne service, evidence of pre existing damage, etc.

6. Tenant’s Rights in Victoria : How to Handle if You Disagree with a Bond Deduction

In Victoria, tenants have the right to challenge the unfair bond deductions by landlords. All you need to do:- Ask for the final Inspection Report: You can collect the complete exit condition report, photos of dirty areas, and reasoning for each deduction. This is your right as a renter.

- Compare the Condition Reports: You must compare the initial report with the exit one to see cleaning issues

- Communicate and Negotiate with your Landlord:Let your landlord know the reason behind the dispute for the deduction. Be factual and attach necessary evidence. Disputes can be resolved mutually through discussions. You can re clean the property to clean leftover grime and gunk.

- Look for Mediation:If both parties don’t agreement, contact Rental Dispute Resolution Victoria to resolve the matter. This is a formal but non tribunal decision that often resolves issues related to cleaning.

- Apply to VCAT:When there is still a bond dispute, both parties can go to VCAT for a final decision. Ensure you apply within 14 days after the bond deduction notification. VCAT will thoroughly review the evidence provided by you or the landlord and make a final decision based on it.

7. How End of Lease Cleaners Reduce the Chance of Bond Deduction

Highly trained professionals follow a pre-approved checklist, carefully read rental agreements, and cleaning clauses to offer a top quality end of lease cleaning Melbourne. They leave no stone unturned to clean every inch of the premises using tried and tested methods. From cobwebs, stubborn stains, caked on grease to bathroom gunk, every nook and cranny is cleaned properly to impress your landlord. The best part is that good companies offer a bond back guarantee (Ts and Cs apply) and a free re clean in case of missed spots to help you secure the full bond back. It is good to ask necessary questions before hiring experts for the move out cleaning. Make sure you stay available during the inspection to prevent unfair deductions.

Infographic: Understanding Cleaning Related Bond Deduction In Victoria

Wrapping Up

Attention to detailed cleaning is unavoidable when preparing your property for the final inspection. However, if you lose bond money due to cleaning issues, consider this guide as a roadmap to resolve the issue and get your full bond back in Victoria without any disagreement.